One of the great frustrations of any world traveler is the cost exchanging currency and paying bank/ATM fees. It’s money that just vanishes but there are ways to avoid and minimize these costs when it comes to both credit cards and cash ATM withdrawals.

(note this is long, but totally worth reading for any fellow international travelers)

Credit Cards:

First. It’s good to be American. We definitely have by far the best credit card deals available and many, particularly the travel rewards cards, advertise no foreign exchange fees on purchases. For the most part those cards also don’t just bury those costs in bad exchange rates.

I won’t get deep into credit cards here since many others have written endlessly about mile and point earning credit cards. Maybe I’ll write about my setup later, but for now just know that I may never pay for air travel.

That is assuming my plan to rotate through 2 credit cards per quarter while earning an initial spend point/mile bonus works out as expected. Currently I carry a United Milage Plus Explorer (just retired), a Chase Sapphire Preferred and Barclay Arrival World. The later two will be retired at the end of the this trip. When I say retire them I mean that I’ve met the initial spend requirement and earned the 20-50,000 point/mile bonus for having done so so some cards will get downgraded to avoid annual fees in the future and some will get canceled as a new pair of point earning credit cards will move in to replace them.

Some of my bookmarked reading on the subject:

https://www.nerdwallet.com/blog/top-credit-cards/nerdwallets-best-travel-credit-cards/

https://travelwithgrant.com/bluebird/

Ok that was more than I planned on credit cards!

See the thing is that I spend a lot of time in countries were credit cards can’t be used for the majority of purchases. Even here in Thailand which is a highly developed country they can be used at nice hotels and for major purchases, but budget guest houses and street food vendors and the like don’t take credit cards. The few budget guest houses that do take credit cards often pass on the credit card fee (usually 3%) which wipes out most of the benefit in using them to earn miles/points. When I can (planes, trains, etc…), I do use them though and always one of my no foreign transaction fee credit cards mentioned above. Since we mostly stay at budget guest houses and eat from street vendors and small cafes that means having cash… lots and lots of cash.

Cash:

The days of carrying around wads of US currency and exchanging it are long gone. ATMs are everywhere and no amount of banks fees is worth the risk of having large amounts of cash stolen from your room, bag or pocket. (Side note: The exchange rate for travelers checks is so poor that I don’t remember the last time I met someone that wasn’t “fresh off the boat” that gave travelers checks even a moments thought. That leaves us armed with ATM cards and the need to withdrawal lots and lots of cash fairly regularly.

The good news is that like credit cards, ATMs generally have fair exchange rate (Exchange rates do vary by bank though so do research exchange rates for your bank first by asking the current rate and comparing it to whatever xe.com reports if you’re not following my advice below). The bigger problem however is that ATMs often charge fees… sometimes very large fees… particularly here in Thailand.

In Thailand there is an international ATM fee charge of 150THB. That’s roughly US$5 and that’s on top of any fee your bank might charge you for using an out of network ATM. I know people paying USD$8-10 every time they withdraw money from an ATM. Ouch!

The good news is there a way to avoid this!

Schwab Bank High Yield Investor Checking Account:

I only half believed this when my friend KyleTheVagabond told me about this account. He mentioned it to me at a TravelMassive meet up on Maui just a couple weeks before my departure flight for Thailand. Without a lot of time to research it I mostly crossed my fingers and hurriedly signed up for a Schwab Bank High Yield Investor Checking Account as quickly as possible and figured “it couldn’t hurt”. Heck I’d just signed up for 3 shiny new credit cards and a Bluebird card… what could one more hurt. Oh, you’re wondering why… Schwab offers to refund any ATM fees you incur worldwide.

https://www.schwab.com/public/schwab/banking_lending/checking_account

Yes that’s right, no fees and “Unlimited fee rebates from any ATM worldwide”. Sounds too good to be true, right?

Schwab’s account is a bit weird though and Kyle thankfully warned me about all this which I’m passing on to you.

Schwab account setup and funding:

First you have to sign up for a brokerage account and checking account together, not a checking account. Only after signing up for a brokerage account can you get/request a checking account that is attached to the brokerage account. You don’t actually need to use the brokerage account nor keep a minimum balance in it, you just need to have it on order to get the High Yield Investor Checking Account.

Once you’ve got those both setup and you fund the checking account (more on that in a moment) they’ll send you the magical Schwab Platinum ATM/Debit card with which you can withdrawal cash from any ATM worldwide and which they’ll refund any ATM fees you incurred in using.

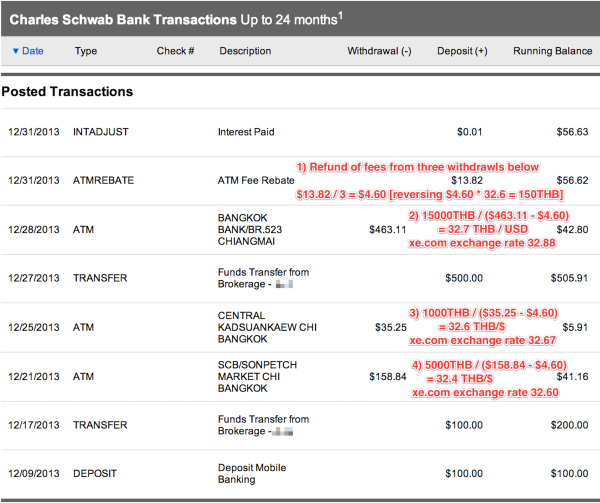

They’ll even refund the $5 per withdrawal fee that Thai banks wrap into your withdrawal. The fee isn’t itemized on my statement, but Schwab refunded it at the end of the month auto-magically without me saying a word. See annotated statement below.

1) Refund of fees from three withdrawals

$13.82 / 3 = $4.60

Reversing $4.60 back to THB at 32.6THB/$ = 150THB (sanity check)

2) 15000THB / ($463.11 – $4.60) = 32.7 THB / USD

xe.com exchange rate 32.88*

3) 1000THB / ($35.25 – $4.60) = 32.6 THB / USD

xe.com exchange rate 32.67*

4) 5000THB / ($158.84 – $4.60) = 32.4 THB / USD

xe.com exchange rate 32.60*

* These are mid-market rates reported by xe.com on each day (mid point between buy and sell). They should be viewed as the best possible rate a consumer might see for exchange in either direction. Someday compare these to what you see on the board at a exchange desk and you’ll be shocked how currency exchange rates are. The rates Schwab is giving here are PHENOMENAL.

Caveats, Strings and Nuisances:

Now the one big nuisance to the Schwab account is that you can’t transfer money from your normal checking account directly into your Schwab Checking account. You have to transfer money it into the brokerage account using their MoneyLink service . There no fee to transfer funds, but it take 3-5 days for the funds to show up in the brokerage account and then once it’s in the brokerage account there is a 3 day hold before you can transfer that money from the brokerage account into the checking account where you could withdraw it from via ATM.

Long story short. Plan on it taking a week to get money from you’re regular checking out into your Schwab checking account.

There is an alternative, that’s potentially faster. You can if you write yourself a check and then photo capture it directly into your checking and wait for it to clear before withdrawing the funds. However, I rarely travel with more than a half dozen blank checks which I really only carry “in case of emergency”. If I’d planned ahead I might have carried more so I could trying using them as a deposit method into the Schwab account.

$13.82 saved!

In the first two weeks Schwab has saved us $13.82. In the words of my fellow digital nomad here in Chiang Mai, Tyler “That’s a lot of Khao Soi!”.

** Kudos go to anyone who recognizes that the title of this post as an homage to one of my favorite travel novels. Anyone?

Update:

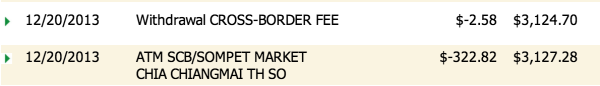

I thought you might want to see by comparison what a normal bank charges. Note that I love my bank, Schools First FCU and have been with them for 20+ years. However, this will illustrate why I will never again withdrawal money directly from my that account when overseas when I can use Schwab instead:

This is a withdrawal of 10,000THB.

Now we know from above we know that $322.82 shown on the statement, is more accurately written ($318.22 + $4.60 ATM Fee) = $322.82.

So first, let’s remove all the fees and see what the conversion rate is all by itself 10000 THB / $318.22 USD = 31.42 THB / USD. This doesn’t sound too awful and is close to what you might get at a currency exchange counter. For reference however xe.com reports the mid-market rate on that day at 32.59. That means instead of a great exchange rate I’m getting a average to poor rate. Uh oh, this is starting off bad.

To get to the real cost of that withdrawal however one needs to roll all the fees in including that separately billed currency conversion fee of $2.58 (FYI that’s 0.008% of the transaction amount) and to keep the international ATM fee in as well.

$318.22 + 4.60 [atm fee] + 2.58 [0.008% conversion fee] = $325.40.

To get to the effective rate we simply do this:

10000 THB / (318.22 + 4.60 + 2.58) = 30.73 THB/USD

Ouch. On a 10,000THB withdrawal I’m paying $7.18 (2.2%) on top of a poor conversion rate on one what is a big withdrawal! The percentage is actual worse on smaller transactions since the 150THB ($4.60) fee is fixed regardless of transaction size.

Ok, so lets compare to Schwab.

If I’d withdrawn 10,000 THB using Schwab (assuming they’d given me a rate very close to xe.com’s mid market rate as they had before) then withdrawing 10000THB @ 32.5 THB/USD would have cost me 307.70 instead of $325.40. That’s a $17.70 USD difference! $325.40 – $307.70 = $17.70 USD.

Yes that’s right. I effectively lost $17.70 by withdrawing 10,000THB from my normal checking account instead of from my Schwab account. Viewed that way Schwab didn’t just save me the $13 in international ATM fees. In three transactions it actually saved me more than $50.